The number of building plans approved for Windhoek during April 2022 declined by around 24% from 247 in March 2022 to 188. This is also significantly less, about 30% fewer, than the 268 approved in April 2021. This year’s April approved plans have a combined value of N$107.6 million and include 114 plans for additions, one commercial plan, 58 house plans and 15 wall plans.

Economists the world over agree that building plans are an excellent economic barometer, as it creates direct jobs as well as income and tax revenue for the State, and significantly contributes to strong economic performance.

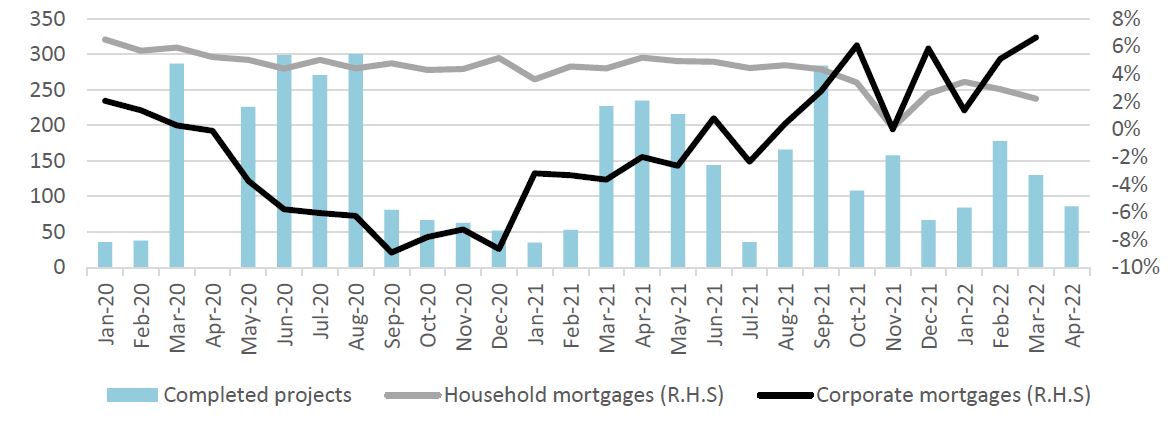

According to stock brokerage Simonis Storm, this year started off to a weaker start than 2021 in terms of construction activity in Windhoek, which has been on a declining trend over the last three-months. For the year-to-date, 478 building projects have been completed, compared to 550 in 2021 and 361 in 2020 for the same period.

In their report, Simonis Storm noted that during April 2022, 86 new building projects were completed, compared to 130 in the prior month, representing a decrease of 33.8% month-on-month (m/m) and 235 in April 2021, representing a decrease of 63.4% year-on-year (y/y).

The completed projects had a total value of N$95.6 million (compared to N$96.1 million for projects completed in April 2021) and were mainly for additions (N$60.1 million), new houses (N$33.1 million) and walls (N$2.4 million).

“We might see more commercial projects taking off in future as annual growth in corporate mortgages has been trending upwards for the year-to-date, whereas annual growth in household mortgages are trending downward,” reads the Simonis Storm report. Meanwhile, additions continue to take up the majority share of new building plans being approved.

“Home additions or improvements might have resulted from certain households creating home offices or upgrading their homes due to being more home bound. In the last two years, Klein Windhoek (monthly average of N$8.1 million), Khomasdal (N$5.5 million), Pionierspark (N$3.9 million), Kleine Kuppe (N$3.1 million) and Otjomuise (N$2.9 million) recorded the highest average value in home additions per month,” Simonis Storm noted.

These value additions are expected to increase house prices in the respective neighbourhoods and support further growth to overall property prices in central Namibia. According to FNB’s House Price Index Report, central property prices increased by 0.5% in 2021 compared to 2020. Furthermore, during April 2022, in Swakopmund, a total of 95 building plans were approved compared to 34 in the prior month and 38 in April 2021. Approved plans at the coastal town have a total value of just under N$120 million and include 94 residential plans and one institutional plan. Simonis Storm stated that the start of 2022 recorded the highest number of building completions in the last two years. For the year-to-date, 133 building projects have been completed in Swakopmund, compared to 121 in 2021 and 131 in 2020.

During April 2022, 38 building projects were completed, compared to 24 in the prior month, representing an increase of 58.3% month-on-month and 34 in April 2021, which is an increase of 11.8% y/y. The completed projects had a total value of N$27.1 million and were mainly for residential additions (N$3.4 million), new houses (N$18.6 million), new flats (N$4.6 million) and additions to commercial buildings (N$424 800).

“The outlook on construction activity seems to be declining in Windhoek, whereas construction activity in Swakopmund might increase based on the year-to-date trend of plan approvals. Faster growth in corporate mortgages might also suggest that we might see an uptick in additions or new commercial properties. Annual change in household mortgages is declining and might suggest that households are using savings to pay for home additions. However, the rise in building costs and interest rates might lead to building project delays or postponements for the plans that have been approved in recent months,” Simonis Storm concluded.